New Requirements for Directors Regarding Director Identification Number

The Federal Government recently passed new laws1 requiring any person who is a director of a corporation, including those corporations registered under the Corporations (Aboriginal and Torres Strait Islander) Act 2006 (CATSI Act Corporations), to get an individual “Director Identification Number” (DIN)2.

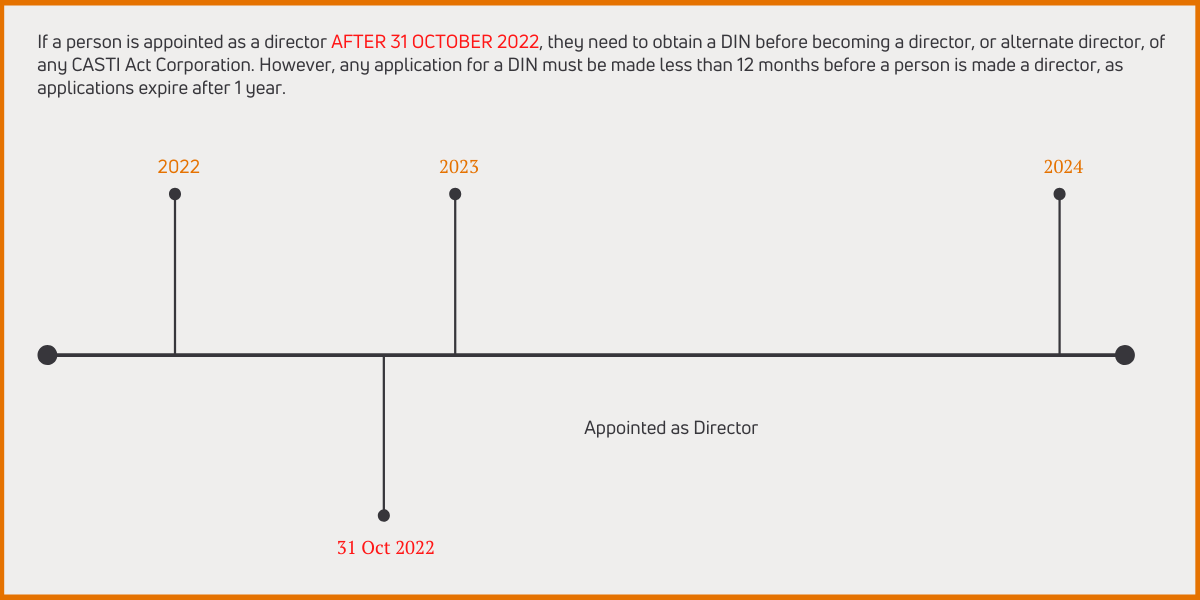

For CATSI Act Corporations3, depending on when a person is appointed as a director (including being appointed as an alternate director) will determine when that person must obtain their DIN4.

How to get a DIN:

There are three (3) ways to obtain a DIN:

- Apply online by setting up a “myGovID” profile (different to a “MyGov” profile for Centrelink purposes) at www.mygovid.gov.au;

- Apply over the phone by calling 13 62 50 and answering some proof-of-identity questions; or

- Apply by completing the form, which can be found at the link below, and posting it to:

Australian Business Registry Services

Locked Bag 6000

ALBURY NSW 2640

All the above options will require three (3) pieces of information:

- Your Tax File Number (TFN); and certified copies of

- Birth Certificate OR Passport; AND

- Medicare Card OR Driver’s Licence.

Due to the requirement for a director to verify their identity, applications for DINs must be lodged personally or with the assistance of, for example, an accountant, but the person applying must be present.

Why are DINs needed?

The Federal Government is attempting to prevent illegal phoenix activities from occurring amongst all corporations in Australia5. Illegal phoenix activities involve directors of one company (Company A) accumulating a large debt as a result of their poor operations and then creating another company (Company B) to continue the business of Company A, but without the debt. The same directors then wind-up Company A by declaring it bankrupt and continue business as usual with a debt-free Company B.

This can be detrimental for any party that is owed money by Company A, such as unpaid workers and suppliers. The Australian Securities & Investments Commission (ASIC) estimates that illegal phoenix activities result in approximately $298 million every year in unpaid wages and entitlements to employees, approximately $1.6 billion in unpaid taxes6, and up to $5.1 billion in losses to the economy7.

By introducing DINs, the government is holding directors accountable, and it makes it easier for the Australian Tax Office (ATO) and ASIC to monitor suspected phoenix activities. For example, in the above scenario, those directors of Company A who become directors of Company B can still be held liable for the debts of the former Company A, or at least allow the out-of-pocket employees and suppliers to warn others of Company B’s untrustworthy directors.

Although illegal phoenix activities primarily occur amongst companies registered under the Corporations Act 2001, a director’s requirements to have a DIN will apply equally to directors of CATSI Act Corporations8.

This information provides advice of a general nature only and should not be relied upon as legal advice.

Published 1 March 2022.

If you have any questions, please do not hesitate to contact; Michael Neal, Matt Patterson & David Knobel

Phone: 07 4041 7622 or 07 5479 0155 Email: reception@paelaw.com

References

1 Treasury Laws Amendment (Registries Modernisation and Other Measures) Act 2020 (Cth) sch 2.

2 Corporations (Aboriginal and Torres Strait Islander) Act 2006 (Cth) s308-10

3 It should be noted that the dates by which a director of a corporation registered under the Corporations Act 2001 are different than those for CATSI Act Corporations.

4 Corporations (Aboriginal and Torres Strait Islander) (Transitional) Director Identification Number Extended Application Period 2021

5 https://www.abrs.gov.au/director-identification-number/about-director-id

6 https://asic.gov.au/for-business/small-business/closing-a-small-business/illegal-phoenix-activity/

7 Explanatory Memorandum, Treasury Laws Amendment (Registries Modernisation and Other Measures) Act 2020 (Cth) 2.2.

8 Ibid